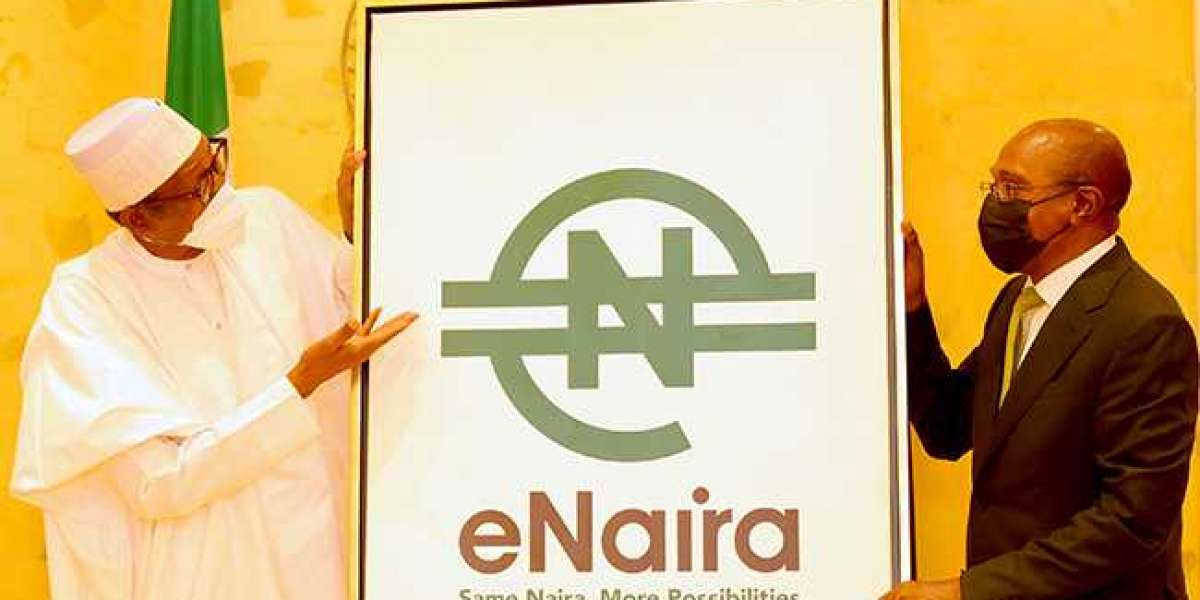

The digital currency was billed to be unveiled on October 1 but was shifted due to other activities slated for the Independence Day celebration.

In announcing the launch of the e-Naira, the CBN stated that the product, which was put together following many years of research, will advance the boundaries of payments system in order to make financial transactions easier.

READ ALSO: eNaira Will Increase Nigeria’s GDP By $29bn, Says Buhari

The apex bank further said that the launch of the digital currency is a major step forward in the evolution of money and vowed to ensure that the e-Naira, like the physical Naira, is accessible by everyone.

Here are six things we all need to know about the e-Naira:

Beyond CBDC

According to the CBN, the e-Naira is not just another CBDC (Central Bank Digital Currency); the platform is said to be a people-oriented digital currency leveraging technology to connect individuals and businesses for easy trading and financial inclusion. The apex bank said it pushed the boundaries, bridged gaps, and told actual humane stories in the process of making the platform. “We are the foremost audience-centric digital currency brandishing a face,” the CBN noted on the e-Naira official website.

Built with current realities

In further explaining how the e-Naira was built, the CBN notes that from conception, the e-Naira has followed a careful thought and implementation process, beginning with understanding current realities in Nigeria’s evolving payment landscape, working with clear objectives and principles built from those realities, meticulously laying out the aspects of the architecture and infrastructure and keeping note of real-time risk management protocols.

Issues regarding cashless policy, National Financial Inclusion strategy, Bank Verification number, Shared Agent Network Expansion Facility, License categorization for the Payment System and Establishment of NIBSS Payment Infrastructure, were all put into consideration.

General benefits

The e-Naira is expected to foster economic growth by offering easier access to capital and financial services which will increase economic activities at low/no interest transaction rate.

It is also expected to provide secure and cheaper diaspora remittance option and make such transactions faster.

Due to its traceability, the e-Naira makes it more difficult for individuals or organizations to indulge in fraud.

While the impossibility of being forged, makes it very strong and reliable, the e-Naira provides financial inclusion by making financial services available to communities without enough banking opportunities.

Local and international trade are expected to be increased with the emergence of the e-Naira, and the nation’s digital currency is expected to aid revenue collection by reducing the cost of handling cash.

Exceptional digital experience

With the e-Naira, diaspora payments are expected to become cheaper and safer as to ensure individuals get more value for every Naira they earn. As regards local payments, people can boycott the queues and pay taxes, and bills from the comfort of their home in an easier and dependable fashion.

Also with the e-Naira, the CBN assures that financial government aids will get straight to the people, as it knocks the middle men out the way and individuals can claim funds directly.

An extra benefit attached is the secure banking which the e-Naira promises.

Those worried about the safety and security of banking details can be rest assured that the transparency makes everything traceable.

Beyond faster and better transactions, the CBN promises that the eNaira makes it possible to send funds, save money, and save time while at it.

More for Individuals, Businesses

Going through the features, one notices that there are specific solutions that are all-encompassing for individuals and organizations. It offers local and international Non-Governmental Organizations and Religious Institutions money transaction solutions that ensures that, at the end of the day, their focus is trained more on carrying out their projects than on the security and usage of the money backing each project.

While everyone can donate every time, the e-Naira is expected to make expense-tracking and report-development for social projects for NGOs, nearly automated. This is as the traceability of each eNaira ensures that balancing ledgers and knowing the exact identity of the recipient of each eNaira occurs at near-real time and in tandem with the very transfer of funds itself.

For business owners, eNaira payment options are expected to help keep customers coming back as they pay for services with such ease. Also with eNaira, the customer base spreads beyond the shores of Nigeria because overseas payment is not just possible but fast and even cheap. According to the CBN, “the more the patronage, the more profit!”.

Furthermore, eNaira makes it easier for business owners to get support allowance from the government because the CBN has their wallet information and can make direct deposits on behalf of the government.

Government is also expected to experience an increase in revenue and this according to the apex bank is due to the fact that through reduction in cash handling costs and more transparent taxing systems, eNaira makes more funds available for development projects such as better feeder roads, affordable education, and more equipped health facilities.

It is projected that spending eNaira will make for a richer Government and a richer people.

Unified Payment System

Customers can move money from their bank account to their eNaira wallet with ease. They can also make in-store payment using their eNaira wallet by scanning QR codes.

Individuals can monitor their eNaira wallet, check balances and view transaction history with ease and the platform allows users to send money to one another through a linked bank account or card.

The cost for sending and receiving money faster, easily, will come at a very minimal costs, the CBN promises. There is always a transaction history and as such, customers can verify their payments anytime and anywhere.

On the eNaira official pages, the CBN stated that intra/inter financial institutions transactions are not only possible, they are faster and cheaper. In addition to this, customers can enjoy speedy transactions across boundaries and a hitch-free foreign exchange.

In conclusion, the eNaira serves as both a medium of exchange and a store of value, offering “better payment prospects in retail transactions when compared to cash payments”. It also has an exclusive operational structure that is “both remarkable and nothing like other forms of central bank money,” CBN notes in its official page.

According to the CBN, the objective is to see eNaira enable households and businesses to make fast, efficient, and reliable payments, while benefiting from a resilient, innovative, inclusive, and competitive payment system.